The Role of Salesforce in Driving Customer-Centric Digital Transformation in Auto Insurance

These days, technology is changing the world very fast, and it is having a great impact on auto insurance companies.

Traditional auto insurance companies are increasingly utilizing digital tools to satisfy customers, earn their trust, and remain competitive in the ever-changing market. Salesforce is playing a significant role in this transformation, offering exceptional capabilities in developing and managing customer relationships. Its focus on understanding customer needs is beneficial for various businesses, including auto insurance companies.

Jumping into the Digital Age for Car Insurance

In the past, Car insurance companies were old-fashioned and used complicated and tricky methods. These days, with the development of extraordinary and new gadgets, companies have also changed their way of working. When they go digital, car insurance companies use tech to work more, handle risks in more professional ways, and provide customers with a better experience.

Through digital tools and systems like Salesforce to manage customers’ information, these companies can communicate effectively with anyone to manage tasks, make things run efficiently, and understand what the requirements of their customers are.

AI in Auto Insurance

AI is revolutionizing every part of car insurance companies, from claim handling and customer support to policy writing and pricing. Algorithms powered by AI analyze vast databases to better predict risk, resulting in fairer prices and less cheating.

Accenture’s report shows that AI can help save $390 billion by 2030 by boosting efficiency and automating processes. AI in car insurance can bring a revolution, like chatbots and virtual assistants, through which customer interaction can be increased. It provides immediate assistance and personalized recommendations, which increases customer satisfaction.

AI in Auto Insurance: A Game-Changing Integration

AI has revolutionized the world of car insurance. Combining AI with Salesforce has given insurance companies some new, wonderful abilities. According to Accenture’s study, three out of four big shots in insurance think AI will shake things up or change how insurance works in the next few years.

Salesforce Einstein, which is the AI part built right into Salesforce, is leading this big change. Here’s how car insurance companies are using AI with Salesforce:

- Predictive Analytics: Einstein’s ability to predict helps car insurance companies better understand customers, identify problems, and set prices. According to a study by Deloitte, insurance companies that use AI to predict have generated 13% more revenue from underwriting.

- Automated Underwriting: AI algorithms can analyze a lot of information to determine risk and make decisions about underwriting without people. McKinsey says this AI-powered underwriting can make risk checks go 90% faster.

- Fraud Detection: Einstein’s smart machine learning algorithms can detect weird stuff and patterns in claims information to find possible scams. The group fighting insurance scams thinks that by using these smart programs to detect scams, companies can save up to $32 billion each year.

- Chatbots and Virtual Assistants: Salesforce Einsteins Bots can answer customers’ everyday questions, helping human workers focus on more important things. Juniper Research predicts that car insurance businesses can save $1.3 billion in running costs by 2025 with the help of these chatbots.

Key challenges facing the industry include:

- Customers want more personalized digital experiences

- Auto insurers need to assess risk and price policies more accurately

- Companies have to boost productivity to stay competitive

- The industry must adapt to new trends like ride-sharing and self-driving cars

To address these issues, car insurance companies are moving to online platforms and putting customers first in their plans.

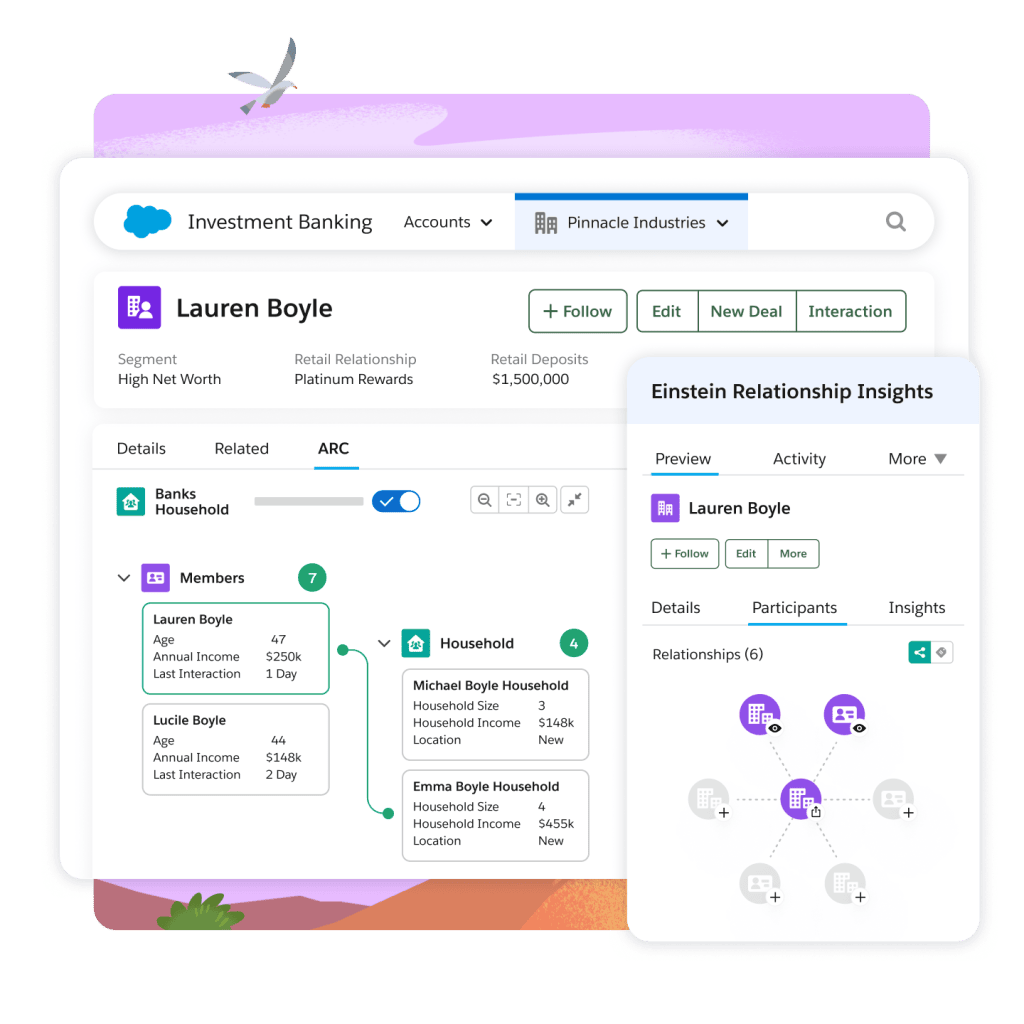

Making Things Better for Customers by Putting Data Together

Through gathering and analyzing customer data from multiple sources, Salesforce has made a huge impact in the car insurance world. It helps insurance companies in many ways. It provides a full list of each customer helping them with what people do, where they are in their life, and what they prefer. This allows insurance companies to provide customers with a customized experience, predict what customers might demand before they ask, and offer the right products. This results in the satisfaction of customers and the development of healthy relationships between the company and customers.

Using Internet-connected Devices to Track Driving and Assess Risk

In insurance companies, the growth of the Internet of Things (LOT) has made it simpler to assess risks and customize prizes. These devices collect real data about the driving habits of customers, the performance of vehicles, and the surrounding environment effectively. When insurance companies feed these Internet of Things devices into Salesforce’s CRM platform, they can get more professional and valid data about each policyholder’s risk profile and driving patterns. Through this data-driven method, insurers can get usage-based insurance (UBI) plans through which they can have good rates for careful drivers, making insurance more equitable and customer-focused.

Following Rules and Keeping Data Safe

Insurance companies face a messy world as they are going digital with time. For this, they have to follow strict conditions about data protections, like GDPR and, CCPA. This is crucial for Salesforce to take the data safely. To protect customer’s private information, they use strong encrypted codes, limit access, and keep detailed records. Insurance companies can gain more trust from customers by following the rules and using smart data handling methods. At the same time, by using all this data, auto insurance companies can find the interests of customers to grow their business and come up with fresh ideas.

How Guessing What Customers Will Do Helps Keep Them Happy

Auto insurance companies can have a fresh way to predict what customers want from Salesforce’s smart guessing. It checks out the previous data and uses AI to work things out. Through this insurers can create multiple groups for their customers and come up with new and amazing ideas for the customers. These new and clever models not only talk about the time spending routine of customers but also alarm if the customers are wanting to leave. This allows insurance companies to try to hang onto customers and sell them more stuff. Insurers can chat with customers effectively and easily, make them happier, and grow their business for years by using the salesforce’s tools.

Salesforce: Making Big Changes Happen

Salesforce has revolutionized the world of insurance. It provides car insurance companies with a large number of advanced and cool digital tools to solve their problems. For example, Salesforce’s Financial Services Cloud and Einstein Analytics keep the records of customers in one place for the insurance companies. These tools can also do some other tasks as well. Through these tools, one can feel special even when he is talking with tons of people. Through this combo of cool tools, car insurance companies can develop healthy and real relationships with their customers. It helps the business to run smoothly.

Salesforce: Powering Customer-Centric Transformation

The emergence of Salesforce is revolutionary in the auto insurance industry. It provides a wide range of tools and capabilities through which customers can have exceptional experience while streamlining their operations. Salesforce is making the change in these ways:

- Through the Customer 360 Salesforce platform, insurance companies can get a complete glimpse of the customer’s likes and dislikes from all angles. Information like policy details, contact details of the people, and the policy details are present in one place through this software. A study shows that a 34% increase in customer satisfaction has been recorded in companies that leverage Customer 360.

- With the help of the Salesforce marketing cloud, auto insurance companies can create customized marketing campaigns for their customers. They collect information about the customers’ dos and don’ts. Salesforce’s state of marketing report says companies can increase their selling percentage up to 26% by doing this kind of personal marketing. It looks amazing when you talk to each person in a way that fits them.

- With the help of the Salesforce cloud, insurance companies can better handle the claims, cutting down on their customers and making them happier. According to a study by J.D. Power, car insurance firms that are using digital tools for their claims service have gained a 22% increase in customer satisfaction. This digital tool is changing the world in a smoother way to deal with claims.

Enhancing Customer Experience with Salesforce

Salesforce’s customer-centric approach is helping auto insurers transform the entire customer journey:

- Through Quote and Policy Management, Salesforce CPQ (Configure, Price Quote), car insurance companies can make accurate quotes fast and quickly without any trouble. The study by the Aberdeen group shows that the companies that use CPQ for their business receive a 105% larger average deal size.

- Self-Service Portals Community helps insurers create self-service portals for customers where they can manage their policies, access information, and claim policies. According to a Gartner report, by 2025, 80% of auto insurance companies will have abandoned native mobile apps and switched to messaging to give customers a better experience.

- Salesforce’s omnichannel ability ensures that customers get the same response across all channels. According to a study by Aberdeen Group, car insurance companies that can easily talk to customers on multiple platforms retain up to 89% of their customers. On the other hand, companies that are not good at this keep only 33% of their clients. This study shows that talking with customers efficiently in many ways has a big impact on keeping them around.

- IoT Integration Salesforce IoT Cloud allows insurers to collect data from connected devices, such as telematics devices in cars. Berg’s study says the number of insurance telematics policies will likely hit 125.7 million worldwide this year, which means a CAGR of 23.1%.

Measuring the Impact of Salesforce on Auto Insurance

The auto insurance industry has seen big improvements in important areas because of Salesforce:

- Customer Satisfaction: The companies using Salesforce had a 35% boost in customer satisfaction and happiness.

- Getting Things Done Better: According to an IDC report, Salesforce customers cut their IT costs by 25% on average, and their workers got 27% more done.

- Making More Money: Salesforce users make 27% more money.

- Faster New Stuff: Nucleus Research conducted a study and found that Salesforce helped companies launch new products and services 70% faster on average.

Example: XYZ Insurance Company

This company can coordinate with customers in more personal ways and increase the price of its products. This XYZ company shows that Salesforce is the backbone of a company and can make it run smoother by focusing on customers’ needs.

Future Trends and Outlook

In the car insurance world, AI, lot, and predictive analysis are going to bring a huge revolution. Car insurance companies can use these tools to offer better, more personalized, and quicker personalized services to customers. With tech-savvy folks becoming the main customers, car insurance companies are required to become faster and zero in on what customers demand. They can do this by using stuff like Salesforce to stay ahead of the game and come up with fresh ideas in the ever-changing insurance scene.

Wrapping up

As car insurance companies are going digital, they can now focus more on customers’ requirements and needs. It provides insurers with a complete system with AI, data tools, and ways to connect with customers. With the help of these tools, insurance companies meet what their customers want now while also working better and growing more.

The car insurance world keeps changing. Insurance companies that use Salesforce to its fullest will do well in this digital time. They’ll give customers great experiences and stay ahead of other companies.