A Complete Guide to Market Research for Product Development

Every idea is amazing to the person who thought of it. We think of something creative and start imagining people lining up to buy our product. While it is great to use your creativity to develop something new, making big investments of time and money into something that only you think will work is never a good idea.

It all starts with your idea. If you are creative and experienced in your field, you can come up with something brilliant that will make your business succeed greatly. Still, there is no reason why you shouldn’t test your idea before you turn it into a product.

Think of it this way – you can’t really read your customers’ minds. You might think you know what they want, but you can’t really know it unless you test this.

This is where market research comes into the picture. Thanks to market research, you can check if the product you are very enthusiastic about will yield the interest of your target audience. Does it fit the current trends on the market, or is it too early/ late to get it out there? Will they understand it? Will it meet their needs?

If you want to ensure that your product reaches its full potential and discover ways to improve it, this guide is made for you. We’ll cover the most important information and provide tips on conducting market research for product development. By following this guide, you’ll gain insights that can help you refine your product and better meet the needs of your target audience.

Market research in product development: what does it mean?

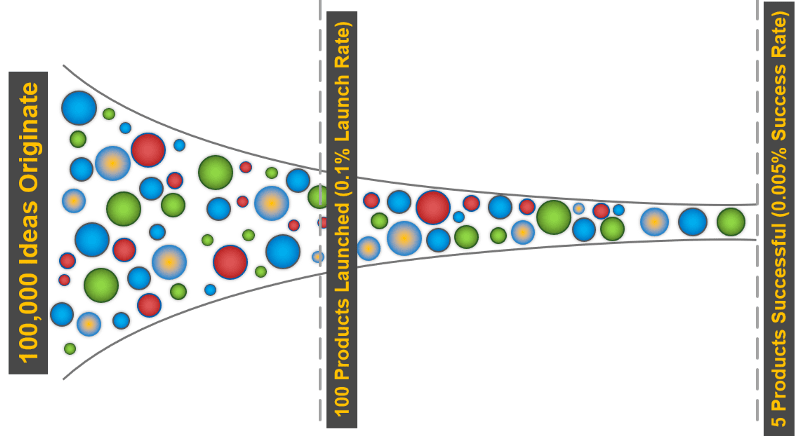

Every year, over 30,000 new products are launched on the market, and 95% fail. This number is devastating, but it is the reality.

But why do they fail in the first place?

There are so many reasons for it. Harvard Business Review lists just a few of them: the product falls short of claims, the price isn’t right, there’s no demand for it on the market at the moment, and more.

Interestingly, the majority of these products are simply launched without proper market research.

Whether it is a glitch in the development or the idea is not trending with the targeted audience, market research could prevent many of these products from failing.

The information you collect during market research can guide and optimize every part of the product development process. This starts with brainstorming and research of the new product’s creation, marketing, and selling. Companies providing MVP development services rely heavily on such data to provide more accurate product validation and a more successful go-to-market strategy.

Long story short, researching the market can tell you what to sell, where and when, and even how to sell it. It is a collective process in which you can brainstorm, develop and modify based on your idea and market data.

Why is market research important for new product development?

Market research will help you base your product decisions on actual data, not just ideas or guesses. Instead of spending tons of money on products that won’t work in your market, you can use the research data to deliver something your audience needs – or find the right way to present what you have.

This approach not only minimizes risks and maximizes sales but also equips you with valuable data to present to investors and stakeholders. In today’s landscape, people are less likely to believe in or invest in ideas without solid backing. Therefore, market research is essential in providing the necessary data to build confidence and support for your initiatives.

Understanding the different types of market research – and how to perform it

If you want to perform market research, you need to learn more about it. There are many categorizations and types of it, all perfect for different stages of product development. Askatest, one of the top-rated tools for performing research of different kinds, will help you distinguish between the main types of market research. On one hand, we have primary and secondary. On the other hand, we have quantitative and qualitative market research.

Let’s dig into this.

Primary vs. Secondary

Primary research includes the collection of raw data that comes directly from the market or your customers, thanks to your own research. You’d be using surveys, interviews, and focus groups, not third parties, to collect this data. Considering how evolved today’s AI surveys are, you could never underestimate their contribution to your primary research.

Collecting information directly from targeted buyers provides the most accurate data for the product development phase. Your strategies will be based on these findings, derived directly from the market.

Secondary market research, on the other hand, includes using existing data. Don’t think that this is any less helpful. The information already available can be extremely useful to you, especially when you combine it with your primary research data. Moreover, you can even use Python ETL to extract, transform, and load data from various sources into a unified database for analysis.

In secondary research, you’d be identifying business risks based on market trends and developments. You can also research the competition to understand your options and the behaviors of customers. These are very useful for the product development process.

Quantitative vs. Qualitative

Unlike that popular saying, ‘choose quality over quantity, market research will provide you with loads of data – which will be very helpful. Quantitative research for product development focuses on things that are measurable.

For example, you’ll want to learn how many people would like to buy the product you are creating. You’ll want to learn what they’ll be willing to spend on it. When you put it out there or send some samples for testing, you can use quantitative research to see if they are happy with what you created.

But, if you want to understand the reasons why you have a small number of customers, why they won’t pay more, or why they behaved the way they did, you need qualitative research.

With qualitative research methods, you give context to the numbers obtained via quantitative research. This means that they work best when used together. You can’t expect to send out a few surveys and get all the data you need for your product development.

If you follow up your quantitative research with qualitative, you’ll understand the thoughts and behaviors of your audience. Basically, you’ll learn how to read their thoughts and, based on it, can create strategies to attract, convert, and retain them.

How do you gather all this data?

Gathering such huge amounts of research is time-consuming and hard. Evaluating it is even harder. But, there’s a simple solution: You can use Askattest to create your research tools, implement them, and even evaluate them.

Attest is a cutting-edge platform led by research experts that will help you create, send out, and evaluate all sorts of tests and surveys to get the information you need for product development.

Steps for market research for product development

Now that you know what this means and why it is important – as well as how you can make it easier for your business, it’s time to get some actionable tips on the matter. Here are the steps you should follow when researching the product development market.

Step 1: Do exploratory research

The first step is to figure out what you’ll be researching. You can’t research the entire market with a single survey or do a Google search and be over with it.

In the beginning, you’ll have no idea where to gather the research data you need for product development. This is why the first step is exploratory research.

In this stage, you’ll gather secondary data on different aspects. You’ll find important things that might not be important, things you didn’t know existed, and things that you might want to eliminate from your strategy.

You’d be researching your competition and the market in general, going over forums and social posts that show you what customers look for in your industry. You might have to use web scraping tools and Cloudflare bypass to conduct in-depth competitor analysis and gain valuable insights.

You are done with these steps when you know what your customers need, their pain points, and how you can make their lives easier. This information can then be used to develop an MVP—a basic version of the product with just enough features to be useful and get feedback from early users. Successful minimum viable product examples include Dropbox’s file-sharing demo video, Airbnb’s website with just a handful of listings, and the first version of the Lean Canvas business model.

Step 2: Define your objectives and the scope

When the exploratory research ends, you’ll have an idea of what you need. At this point, sit down and define your objectives. What will you focus on? Will you research to get a competitive advantage, or will you focus more on your customer’s needs? Do you want to find more data about your new product’s pricing or usage habits?

Based on these objectives, figure out the scope of your research. How many people can you send out surveys to? Where do you need primary data, and where can you use secondary data?

Step 3: Do evaluative research

At this stage, you’ll do the actual hard work. You’ll create surveys and questionnaires, get feedback, do pricing research and concept testing, roll up your sleeves, perform online research and testing, etc.

Once you gather this data, you need to evaluate it, develop ways to improve your product strategies and decide what to invest in.

Have you done all this? You’re ready!

When you do all this, you are ready to launch your product. This might not be the recipe that guarantees success, but it makes the success of your product much more likely to happen.

Remember – research is a work in progress. You should never stop conducting research and tracking metrics to keep your business and products trending.

One very smart move at this point is to see how you can automate all your data to get better metrics. Cazoomi can help you automate everything and get detailed reports to keep track of your product’s progress and success. Take it for a test drive today.